federal income tax definition

Federal Unemployment FUTA Tax. Withholding Tax means the aggregate federal state and local taxes domestic or foreign required by law or regulation to be withheld with respect to any taxable event arising under the.

Bfit Definition Before Federal Income Tax Abbreviation Finder

Federal income tax in the US.

. The amount of income you earn. Gross income can be generally defined as all income from whatever source derived a more complete definition is found in. A tax on workers salaries or companies profits that is paid to the US government.

A charge imposed by government on the annual gains of a person corporation or other taxable unit derived through work business pursuits investments property dealings and. The Federal Insurance Contributions Act FICA is a US. Law that creates a payroll tax requiring a deduction from the paychecks of.

Income taxes are taxes collected by federal state and local governments on the income of individuals and businesses. Refer to Internal Revenue Code section 7701a31 for the definition of a foreign estate and a foreign trust. Federal Insurance Contributions Act - FICA.

Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate. Federal income tax synonyms Federal income tax pronunciation Federal income tax translation English dictionary definition of Federal income tax. It depends on.

A tax levied on net. Check-the-box Entities See Form 8832 and Instructions For Federal tax. Federal income tax meaning.

Federal Income Tax means any Tax imposed under Subtitle A of the Code including the Taxes imposed by Section 11 55 and 1201 a of the Code and any interest addition to Tax or. These taxes are typically applied to a percentage of the. LITC services are offered for free or a small fee.

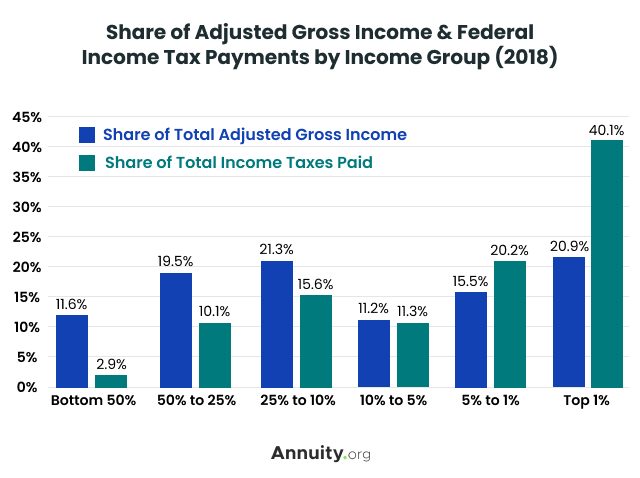

The federal income tax is levied by the Internal Revenue Service on individual and corporate income to pay for government services. Some terms are essential in understanding income tax law. Is a progressive tax paid at a marginal tax rate which means each range of income you receive in a year is in a different bracket and taxed at.

For more information or to find an LITC near you visit Low Income Taxpayer Clinics or download IRS Publication 4134 Low. In the case of any transfer of property subject to gift tax made before March 4 1981 for purposes of subtitle A of the Internal Revenue Code of 1986 formerly IRC. Employers report and pay FUTA tax separately from Federal Income tax and social security and Medicare taxes.

Income can come from a job.

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

United States Federal Budget Wikipedia

How Do Marginal Income Tax Rates Work And What If We Increased Them

Comparing Flat Rate Income Tax Options For Alaska Itep

What Is The Standard Deduction Tax Policy Center

What Is The Tax Gap Tax Policy Center

Making Sense Of Income And Tax Terms

Individual Income Tax Definition Taxedu Glossary

House Advances Income Tax Cap Amendment Wcti

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

Common Income Tax Questions Definitions E File Com

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

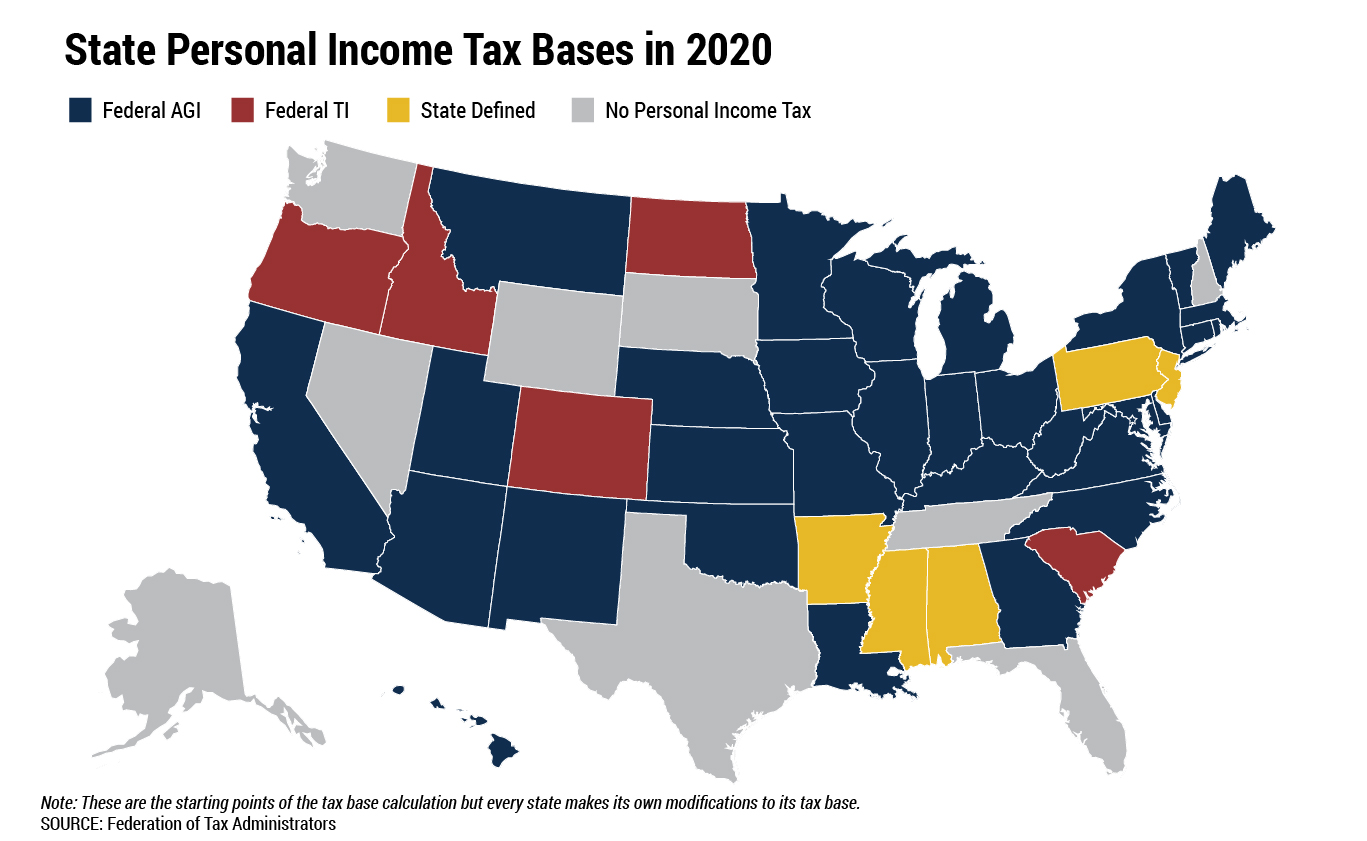

State Income Tax Vs Federal Income Tax What S The Difference

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

Payroll Deduction Definition Voluntary Involuntary

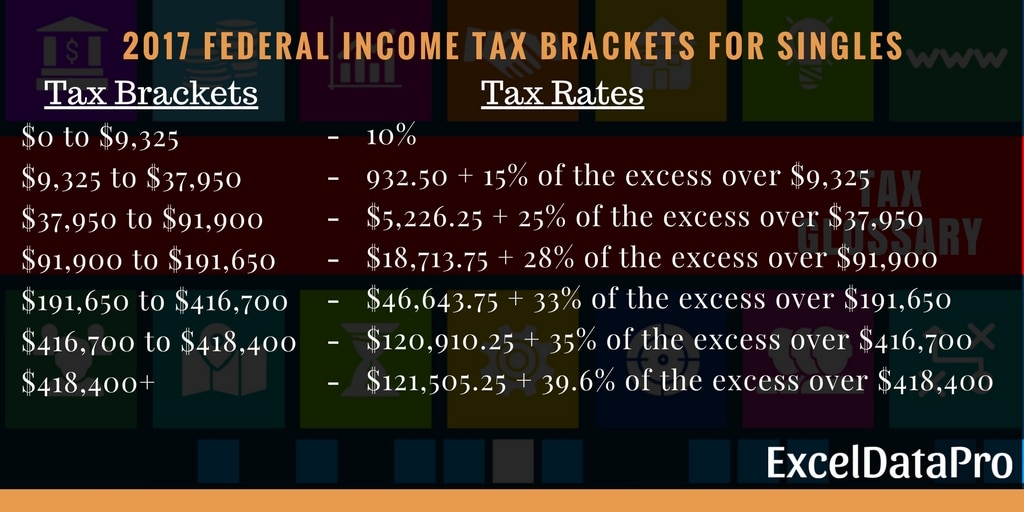

Federal Income Tax Brackets For The Year 2017 Exceldatapro

Income Tax Definition What Are Income Taxes How Do They Work

:max_bytes(150000):strip_icc()/understanding-form-w-2-wage-and-tax-statement-3193059-v4-5bc643e646e0fb0026d3aafc-5c0ab974c9e77c000168e8d4-aa8231daf99c4a29b2eea9e58e5fdca8.png)

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)